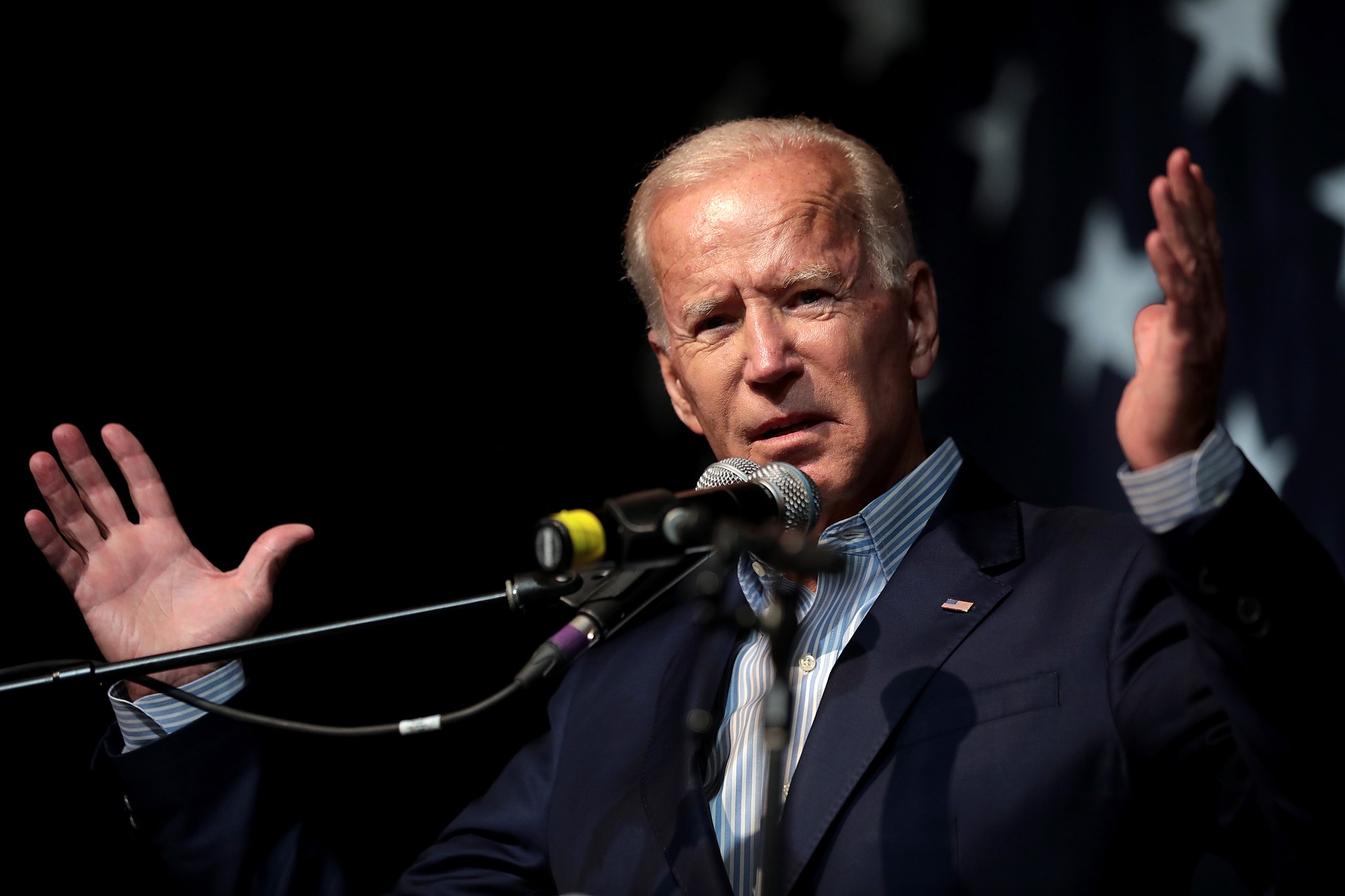

Biden Bankrupts Americans

In the past two years, a significant number of Americans have experienced a reduction in their income due to soaring inflation, posing a challenge to President Biden as he focuses his re-election campaign on “Bidenomics.”

According to Fox, the latest data from the Labor Department, released on Tuesday, reveals that the average hourly earnings for all employees dropped by 3.32%, from $11.43 in January 2021 to $11.05 in October. This means that, despite nominal wage increases, the typical U.S. worker is financially worse off today than they were two years ago.

The primary factor contributing to this decline in financial well-being is persistent high inflation thanks to President Biden, which has eroded consumers’ purchasing power. The government’s report indicates that the consumer price index, encompassing everyday expenses such as gasoline, groceries, and rents, remained unchanged in October from the previous month, with an annual increase of 3.2%. However, when compared to January 2021, prices have surged by a staggering 17.62%.

This inflationary pressure has placed a considerable financial burden on U.S. households, particularly impacting low-income Americans whose already stretched paychecks are highly sensitive to price fluctuations. A recent survey by Bankrate reflects a growing pessimism among U.S. households about their financial situation under the Biden administration. Half of the respondents reported a worsening financial situation since the 2020 presidential election, attributing 45% of the blame to Biden and his economic policies, 35% to Congress, and 27% to the Federal Reserve.

Despite the White House highlighting a yearlong decline in inflation, economists argue that this is mainly due to the Federal Reserve’s aggressive interest rate hikes and the resolution of supply chain disruptions, rather than the effectiveness of the president’s economic agenda. While inflation has decreased from mid-2022 highs, many families are yet to experience tangible relief. The consumer price index remains significantly higher than the typical pre-pandemic rate, leading to increased monthly expenses of around $650 for Americans, according to Moody’s Analytics. Consequently, individuals are depleting their savings and increasingly relying on credit cards to cover essential expenses.