October’s Consumer Price Index (CPI) indicates a significant shift in inflation trends, contrasting sharply with the data from September and signaling a potential easing of inflationary pressures.

This change is crucial as it suggests a more moderate pace of economic activity, moving away from the heightened concerns of September, which hinted at a prolonged inflation issue possibly necessitating further monetary interventions.

Bill Adams, chief economist at Comerica Bank, encapsulates this sentiment, stating, “The inflation fever has broken in the United States.”

Key Highlights from the October CPI:

- The overall CPI remained essentially unchanged, with a negligible increase of 0.04%, primarily due to a significant drop in gasoline prices.

- Core CPI, which excludes volatile food and energy costs, saw a modest rise of 0.2%, slightly lower than in September. This figure has shown a deceleration in its annualized rate, now at 3.2% compared to September’s 3.6%.

- A critical observation is the minimal increase in services costs, excluding housing and energy, which is a focal point for the Federal Reserve when assessing underlying inflation trends. This category also rose by just 0.2%.

Notably, shelter costs increased by only 0.3%, a marked slowdown from September’s 0.6% rise. This deceleration is partly attributed to a 2.9% decrease in hotel and motel prices, suggesting that the previous month’s spike was an anomaly.

Other travel-related sectors also saw price reductions, including airfares and car rental prices, hinting at a possible normalization in the post-pandemic travel industry with supply and demand reaching equilibrium.

Looking Ahead:

Despite these promising signs, risks remain, particularly from ongoing geopolitical conflicts. However, the current data fuels optimism for a gradual return to more manageable inflation levels without severe economic repercussions.

Economist Gregory Daco from EY-Parthenon highlights a combination of factors contributing to this disinflationary trend, including slower consumer demand and easing wage growth, which could pave the way for a smoother economic trajectory into 2024.

Market Response:

Financial markets reacted positively to the October inflation data, anticipating an end to the Federal Reserve’s interest rate hikes. This sentiment is reflected in the significant drop in the two-year Treasury yield and a decrease in longer-term yields, which bodes well for borrowing costs, particularly for mortgages.

The S&P 500 and other risk assets also experienced a boost, with particularly strong performances in interest-sensitive sectors.

The Big Picture:

Federal Reserve officials have recently indicated a desire to halt rate hikes, contingent on softer economic data. The latest CPI figures, along with upcoming reports like October’s retail sales, are crucial in determining the Fed’s next steps. If the trend of moderating figures continues, it could signal a shift towards a more stable economic environment with less aggressive monetary policy interventions.

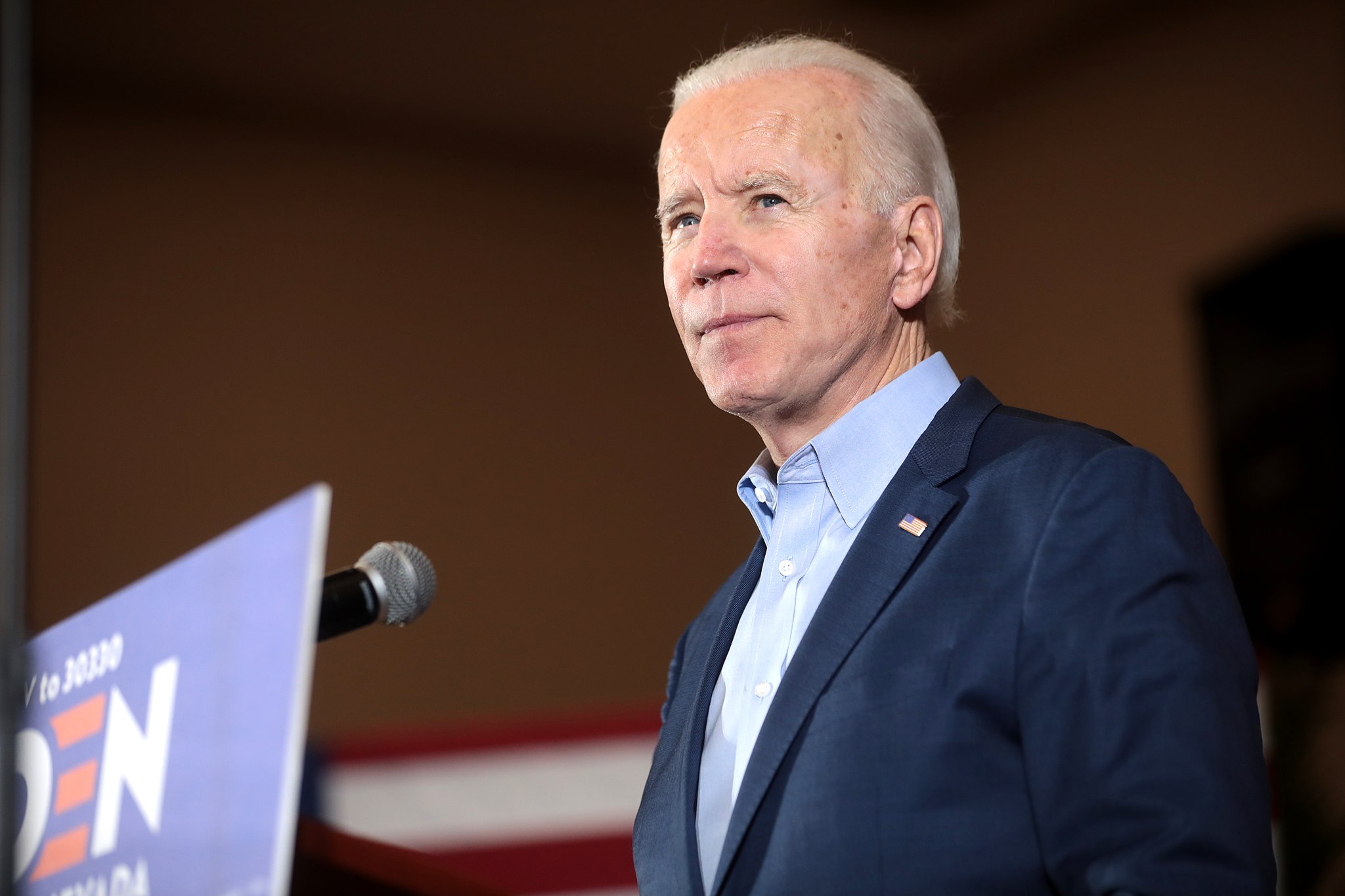

HERE’S WHAT SHOULD HAVE BEEN DONE LONG AGO! THE CORRUPT LAX SUPREME COURT, SHOULD HAVE DECLEARED THE 2020 ELECTIONS FOR WHAT THEY WERE,,,,””FRAUDULENT”. AND,,,,THEY SHOULD HAVE DECLARED TRUMP AS THE RIGHTFUL WINNER, AND RE-INSTATED HIM AS #45. #46 SHOULD HAVE BEEN ABOISHED, ONLY TO BE KNOWN AS A “BAD DREAM”.

THIS, OF COURSE IS MY “PIPE DREAM”, IT WILL NEVER HAPPEN, BECAUSE THE DEMS NOW CONTROL EVERYTHING. THANKS TO THE LAXNESS / CORRUPTION OF THE GOP PARTY, AND THE SUPREME COURT. I DON’T SEE HOW AMERICA WIL SURVIVE ANOTHER YEAR FO WAITING, I THINK THAT WE ARE NOW AT THE, “POINT OF NO RETURN”, AND JOE BIDEN WILL GET US INTO WAR, AS THERE’S NOBODY TO STOP HIM, FROM DOING SO.

THE GOP HAS BECOME A JOKE, AS BAD AS THE DEMS ARE THEY AT LEAST STICK TOGETHER, AND THEY DON’T HAVE RINOS, THAT GO AGAINST THEIR OWN PARTY.