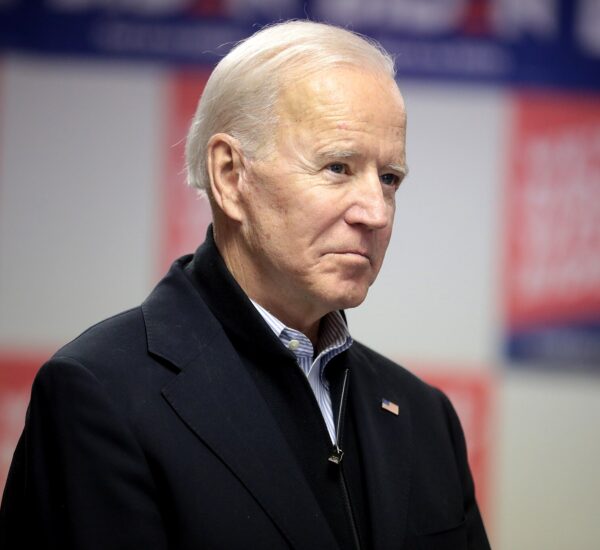

Biden To Eliminate 800K Jobs?

Is Biden trying to lose the upcoming election?

President Biden’s ambitious tax plan is designed to target corporations and wealthy individuals, aiming to rectify economic disparities. However, experts warn that the proposed tax hikes could exacerbate the already delicate state of the U.S. economy.

According to analyses by the Tax Foundation, renowned for its advocacy of lower taxes, Biden’s budget blueprint for fiscal 2025 includes measures that could potentially dampen economic growth in the long term. The foundation predicts a reduction in economic output by 2.2%, a decrease in wages by 1.6%, and the elimination of approximately 788,000 full-time equivalent jobs.

Critics argue that the proposed policies would not only complicate the tax code but also hinder growth prospects. The Tax Foundation report highlights concerns about increased instability and anti-growth sentiments, as well as the expansion of tax-based spending for purposes unrelated to revenue collection.

Among the key proposals are a 25% minimum tax rate on households with assets exceeding $100 million, an increase in the capital gains tax rate, and a substantial rise in the corporate tax rate to 28%. Additionally, the plan seeks to implement a global minimum tax on multinational corporations and close tax loopholes utilized by private equity and hedge fund managers.

Despite estimates suggesting a reduction in the federal deficit by approximately $3 trillion, concerns persist regarding the impact on various sectors. Revenue generated from the proposed tax hikes would partially fund new initiatives, including monthly homeowner tax credits, childcare subsidies, and reductions in prescription drug costs.

Particularly contentious is the proposal to treat capital gains as ordinary income, potentially raising the top tax rate on such gains to 49.9%, exceeding international standards. However, the most contentious aspect, according to the Tax Foundation, is the corporate income tax increase. Rolling back Trump-era tax cuts, the plan aims to raise the corporate tax rate to 28% and increase taxes on foreign earnings to 21%.

The Tax Foundation’s analysis underscores the detrimental effects of higher corporate taxes, predicting a decrease in GDP by 0.9%, a decline in wages by 0.8%, and a loss of 192,000 full-time equivalent jobs. Moreover, uncertainties persist regarding additional proposed measures, such as a new minimum tax on unrealized capital gains and an undertaxed profits rule.

Despite the potential benefits and drawbacks outlined in the proposal, bipartisan support remains elusive in the deeply divided Congress. With Republicans controlling the House, the likelihood of passage for Biden’s tax plan appears slim.