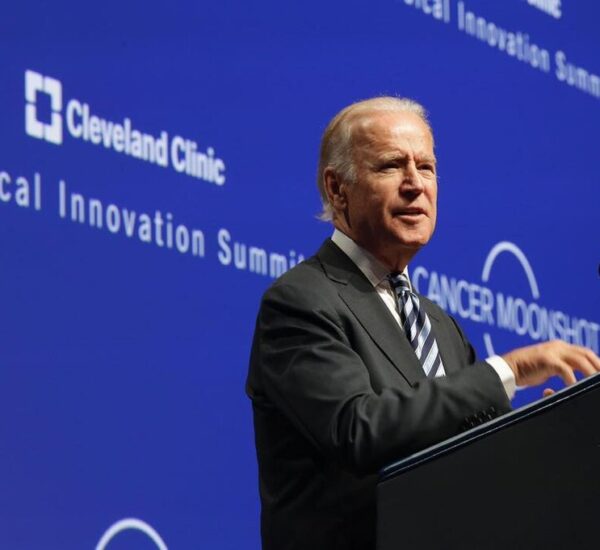

Trump Makes Progress With Powell

Federal Reserve Chairman Jerome Powell delivered a cautious message on Tuesday, signaling that future interest rate cuts will be slow and measured. His stance clashes sharply with Trump-appointed officials who are pushing for aggressive action to revive the economy, protect jobs, and help struggling families.

Speaking at an event in Providence, Rhode Island, Powell defended the Fed’s decision to cut its key interest rate to 4.1% last week, the first cut of 2025. However, he warned against cutting too fast, arguing that it could reignite inflation, which remains above the Fed’s 2% target.

“If we cut rates too quickly, we risk leaving the fight against inflation incomplete and may have to reverse course later,” Powell warned. “On the other hand, keeping rates elevated for too long could unnecessarily weaken the job market.”

This message offers little comfort to millions of Americans struggling with soaring mortgage rates, credit card debt, and rising costs of living — especially retirees and seniors on fixed incomes who are feeling the pinch the most.

Trump Allies Call for Immediate, Aggressive Cuts

Trump-appointed members of the Fed’s rate-setting committee are demanding bold action, arguing that Powell’s slow approach is hurting American workers and small businesses.

- Stephen Miran, a top Trump economic adviser confirmed just hours before last week’s Fed meeting, called for slashing rates to as low as 2% to 2.5%.

- Miran is expected to return to the White House under President Trump and believes bold cuts are critical to restoring economic growth.

- Michelle Bowman, another Trump appointee, warned that the job market is deteriorating while inflation is cooling — the perfect time to lower rates fast.

“We are at serious risk of falling behind the curve,” Bowman said during a speech in Asheville, North Carolina.

“If these troubling trends continue, we must act decisively to prevent deeper economic pain.”

Why This Matters for Seniors and Retirees

High interest rates don’t just affect Wall Street — they directly hit everyday Americans, especially those aged 50 and older.

- Mortgage and car loan rates stay high, straining household budgets.

- Credit card debt becomes more expensive, hurting retirees on fixed incomes.

- Small businesses struggle to grow, impacting local economies.

Lower rates could bring relief to families, while Powell’s cautious stance risks prolonging the pain well into 2026.

Fed Divisions Heat Up

The Fed’s move last week to lower rates from 4.3% to 4.1% was described as a “first step”, with two more cuts possibly coming later this year.

However, deep divisions are now clear:

- Trump’s allies are pushing for immediate, aggressive action to protect jobs and grow the economy.

- Powell and other establishment voices, like Chicago Fed President Austan Goolsbee, want to move slowly to avoid reigniting inflation.

“With inflation above our target for over four years, we must be careful about moving too quickly,” Goolsbee told CNBC.

This divide sets up a high-stakes battle over America’s economic future — one that could shape the 2026 midterms and beyond.

Tariffs, Politics, and Powell’s Pushback

Powell also addressed tariffs, saying they currently have a limited impact on inflation, though that could change.

He indirectly pushed back against President Trump’s criticism of the Fed, denying that politics influence its decisions.

“Whenever we make decisions, we are never thinking about politics,” Powell said.

“Most accusations of being ‘political’ are just cheap shots.”

Bottom Line

The clash between Powell and Trump-appointed Fed officials is about more than just numbers — it’s about the future of the American economy.

- Powell’s cautious strategy risks leaving seniors, retirees, and working families struggling under heavy debt and high costs.

- Trump’s allies are demanding a bold approach to cut rates, protect jobs, and jumpstart growth before the economy weakens further.

With the 2026 elections looming, the Fed’s decisions could become one of the defining political battles of the next year.

https://shorturl.fm/SXiPe

https://shorturl.fm/T0aXV

The greatest home earning method for anyone who wants to make extra dollars every week online. I joined this job 3 months ago, and on my very first day—without any prior experience in online jobs—I made $524. It’s truly amazing. Join now by following the instructions here.

COPY THIS →→→→ http://Www.Cashprofit7.site