Here’s what conservatives need to know.

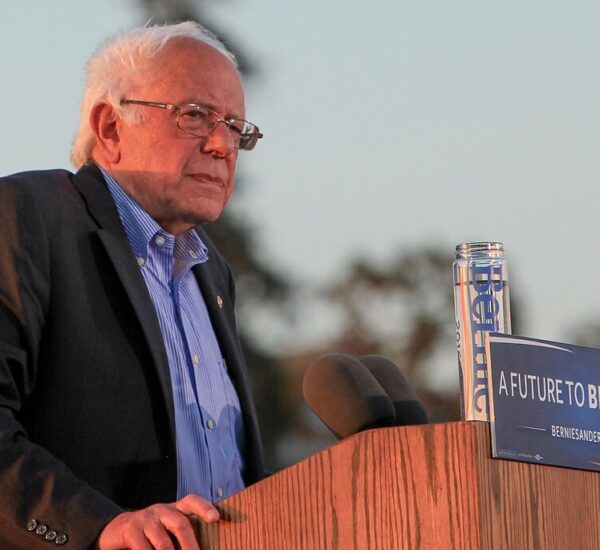

President Donald Trump is once again making headlines—this time over a newly disclosed investment involving Victoria’s Secret corporate bonds, revealed in a recent federal filing.

According to a financial disclosure submitted to the U.S. Office of Government Ethics on January 14, President Trump purchased up to $1 million in bonds issued by the iconic retailer during mid-December. The filing also shows a flurry of additional market activity that could place the president’s total recent investments well above $100 million.

What the Disclosure Shows

Federal ethics rules allow presidents and senior executive officials to buy and sell investments, provided the transactions are properly disclosed and comply with transparency laws such as the STOCK Act. That law, passed in 2012, requires public reporting of financial trades to help prevent conflicts of interest and insider dealing.

Trump’s disclosure covers a one-month reporting window from mid-November through mid-December. During that short period, the president reported two asset sales and 189 separate purchases, spanning a wide range of securities and investments.

If each transaction fell at the top of its required reporting range, the total value of those purchases could reach as much as $160 million, driven by multiple multimillion-dollar buys and dozens of six-figure investments.

Details on the Victoria’s Secret Bonds

The Victoria’s Secret bonds purchased by Trump appear to be standard, publicly available corporate bonds, not private placements or restricted assets. Records show purchases totaling between $250,000 and $500,000 on December 12 and December 16.

The bonds offer an annual 4.6 percent interest rate and are set to mature in July 2029, making them a traditional income-producing investment rather than a speculative play.

Congress Pushes Stock-Trading Restrictions

Trump’s disclosure comes as lawmakers once again debate whether members of Congress should be allowed to trade individual stocks at all.

A bipartisan proposal known as the Restore Trust in Congress Act would force current lawmakers to divest individual stock holdings within 180 days, while newly elected members would have 90 days to comply. The bill, however, excludes the president and vice president, a carve-out that has sparked criticism.

Supporters say the legislation is a practical starting point to restore public confidence, while opponents argue the exemptions undermine its credibility and effectiveness.

Related legislation is moving through the House, and a separate, narrower proposal focused specifically on insider trading has advanced with backing from House leadership.

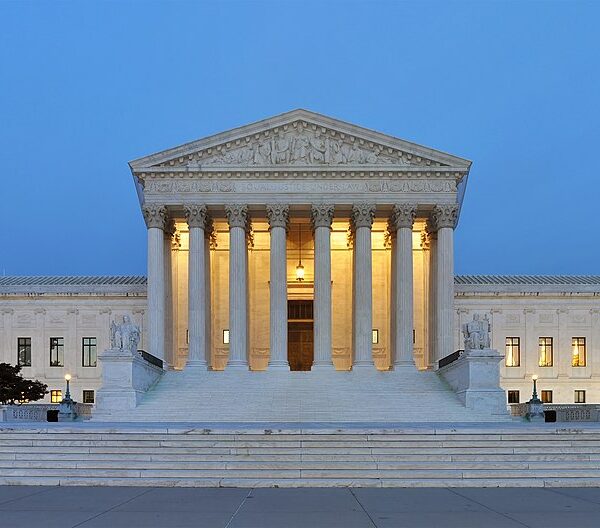

Public Trust and Transparency Concerns

Academic research has repeatedly shown that perceptions of insider trading among lawmakers can damage public confidence in government institutions. Experts warn that when Americans believe elected officials are benefiting financially from their positions, trust in the rule of law begins to erode.

For supporters of stronger ethics rules, the debate highlights long-standing concerns about accountability in Washington. For others, Trump’s filing underscores a key distinction: executive-branch investments are already governed by strict disclosure requirements, while Congress continues to debate whether lawmakers should face similar limits.

Bottom Line

While Congress argues over potential bans and reforms, President Trump’s latest financial disclosure demonstrates the transparency rules already in place for the executive branch—and fuels a broader debate over fairness, ethics, and financial accountability in Washington.