Democrats aren’t talking about this.

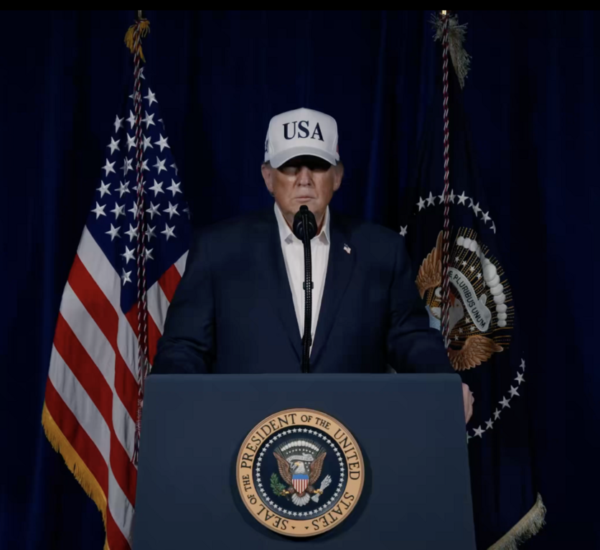

President Donald Trump is highlighting what he calls a major shift for American homeowners: lower mortgage costs after years of sharp increases under the Biden administration.

As inflation continues to squeeze household budgets, housing affordability remains a top concern—especially for older Americans living on fixed or retirement incomes. Trump says his economic policies are beginning to deliver long-overdue relief.

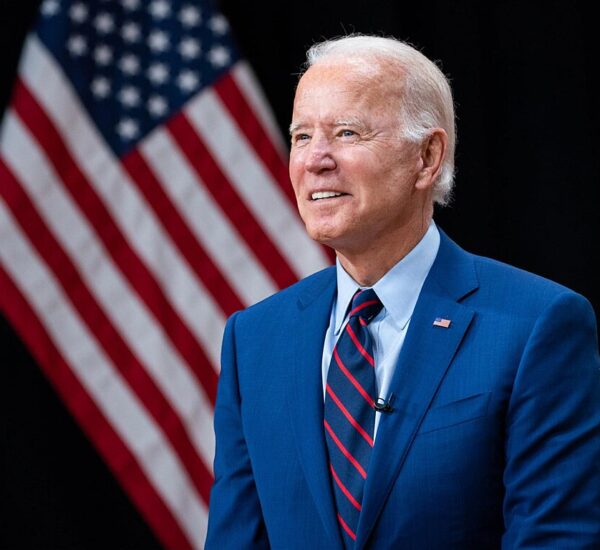

Trump Blames Biden for Housing Cost Surge

Speaking at a rally in Pennsylvania on Monday, President Trump sharply criticized Joe Biden’s handling of the economy, pointing directly to skyrocketing home prices and mortgage rates during Biden’s presidency.

According to figures presented by Trump, annual mortgage payments rose by more than $14,600 under Biden. Since Trump returned to the White House, those costs have fallen by roughly $2,900 per year, based on national averages.

“We went down with our rates. They went up with their rates,” Trump told supporters. “With us, you save nearly $3,000 a year. With them, it costs you about $15,000 more. And the media doesn’t want to talk about that.”

Independent Analysis Confirms Key Trends

Real estate site Realtor.com reviewed the president’s claims and found them largely accurate for newly built homes, though it noted that overall mortgage payments remain higher than they were at the end of Trump’s first term.

A White House official explained that the data shown by the president is based on:

- The median price of new homes

- A 10% down payment

- National average mortgage rates reported by Freddie Mac

Realtor.com’s own analysis produced similar results, with minor differences due to how average mortgage rates were calculated.

Existing Homeowners Also Felt the Pain

The affordability crisis was not limited to new construction.

For existing homes, Realtor.com found that annual mortgage payments increased by about $14,600 during Biden’s term. Under Trump’s current term, savings for existing homes have been more modest—about $540 per year, or roughly $45 per month.

Even small reductions matter for retirees and older homeowners managing rising insurance costs, property taxes, and everyday expenses.

Why Housing Costs Exploded Under Biden

Experts point to two main factors behind the surge in mortgage payments during the Biden years:

- Rapid home price inflation

- A sharp rise in interest rates

From January 2021 to January 2025:

- Prices for new homes rose more than 20%

- Average mortgage rates jumped from 2.74% to nearly 7%

Existing homes were hit even harder, with prices climbing by nearly 50% before slowing more recently.

Signs of Relief Under Trump

Since late 2022, new home prices have begun to trend downward. Mortgage rates have also eased, falling to around 6.2% in recent weeks.

The Trump administration argues these changes reflect a return to stronger economic fundamentals, including tighter fiscal discipline and policies aimed at controlling inflation.

What This Means for Older Americans

For Americans aged 50 and older—many of whom are planning for retirement or living on fixed incomes—housing costs can make or break financial security.

Even modest reductions in mortgage payments can free up money for:

- Healthcare expenses

- Retirement savings

- Rising insurance and utility costs

While economists caution that economic trends can span multiple administrations, the difference in housing affordability between the Biden years and Trump’s current term is difficult to ignore.

As Trump continues to campaign on economic stability and cost-of-living relief, housing affordability is shaping up to be a central issue for American homeowners once again.