Democrats are downright annoying for this one.

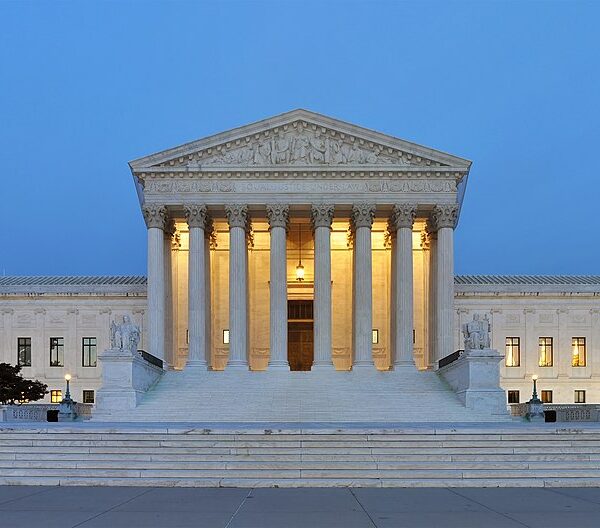

Washington Democrats have opened yet another inquiry tied to President Donald Trump’s aggressive foreign-policy strategy — this time focusing on how Venezuelan oil sales could be handled under U.S. oversight.

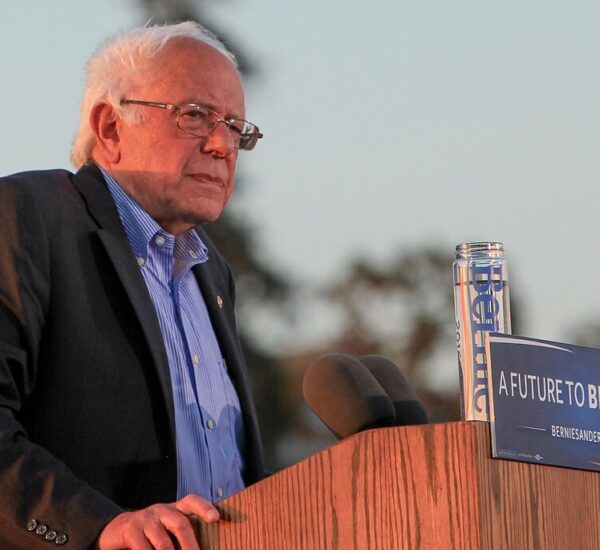

The effort is being led by Sen. Elizabeth Warren of Massachusetts, along with several other Democratic senators, who are pressing major U.S. banks for information about any potential role they may play in facilitating oil transactions connected to the Trump administration.

The scrutiny follows Trump’s announcement that Venezuela’s interim leadership would transfer up to 50 million barrels of oil to the United States, with sales expected to move quickly. According to the administration, proceeds from those sales would be placed under U.S. control as part of a broader strategy tied to national security and foreign policy interests.

Banks and Treasury Accounts Under the Spotlight

On January 7, the Department of Energy confirmed that executing the oil sales would require assistance from “key banks” capable of handling large-scale international transactions. The department also noted that proceeds would be held in U.S.-controlled accounts at internationally recognized financial institutions.

Just days later, on January 9, President Trump signed an executive order declaring a national emergency aimed at protecting Venezuelan oil revenue held in U.S. Treasury accounts. The order was designed to prevent those funds from being frozen or seized through legal action, ensuring they remain available to support U.S. policy objectives.

Democratic lawmakers say the administration has not publicly identified which banks may be involved, prompting questions — from their perspective — about transparency and oversight.

Democrats Demand Answers From Wall Street

In letters sent to several financial institutions, the senators argued that some oil proceeds could be routed through the U.S. Treasury despite originating from a foreign nation. They also questioned whether portions of the revenue might ultimately pass through private-sector banks.

The lawmakers asked whether the Trump administration contacted banks about participating in oil sales, providing financial backing, or holding proceeds in U.S.-controlled accounts. They also requested records of any communications related to Venezuelan oil operations.

Institutions contacted include Bank of America, Goldman Sachs, and UBS, among others.

Banks have been asked to respond by the end of January and to provide ongoing updates regarding any future communications with the administration.

White House Response and Broader Context

The White House did not immediately respond to media requests for comment.

Earlier this month, President Trump announced that U.S. forces had taken decisive action in Venezuela and confirmed the capture of longtime strongman Nicolás Maduro. Trump stated that the United States would temporarily oversee the country’s transition until a stable and peaceful government could be established.

Supporters say the move reflects Trump’s firm America-first leadership style, prioritizing energy security and geopolitical stability. Critics, meanwhile, argue it raises new legal and financial questions.

What’s clear is that Trump’s second-term agenda continues to disrupt Washington norms — and every major move is now being met with aggressive oversight from political opponents.