Trump is fighting back.

President Donald Trump said Saturday that he is considering legal action against JPMorgan Chase, signaling a possible lawsuit within the next two weeks over the bank’s decision to close his accounts following the January 6 Capitol unrest.

In a post on Truth Social, Trump accused JPMorgan of what he described as an unjustified account closure, arguing that the bank acted improperly after the January 6 protest and under outside political pressure.

Trump said the move abruptly ended a banking relationship that had lasted for decades. According to Trump, the bank provided him with roughly 20 days to move large sums of money, a timeline he has previously criticized as unreasonable.

The dispute comes amid broader tensions between major financial institutions and the Trump administration. JPMorgan has recently taken public positions opposing aspects of the Justice Department’s criminal inquiry involving Federal Reserve Chair Jerome Powell.

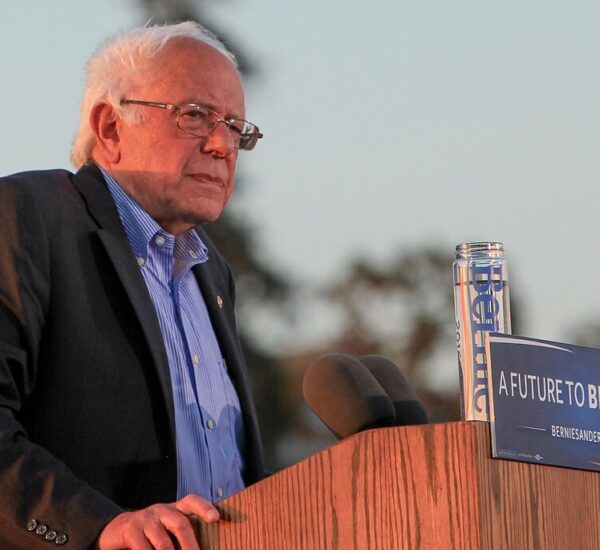

JPMorgan CEO Jamie Dimon has warned that actions perceived as weakening the Federal Reserve’s independence could contribute to higher inflation expectations and rising interest rates—issues that directly affect retirees, homeowners, and savers.

At the same time, the White House has proposed a temporary cap on credit card interest rates, a policy aimed at addressing consumer costs. JPMorgan executives have cautioned that such limits could reduce credit availability, particularly for seniors and middle-income households.

Trump’s potential lawsuit revives a long-running dispute dating back to 2021, when several large banks ended their relationships with him after he left office. Trump has repeatedly stated that the decision was politically motivated rather than based on standard financial risk.

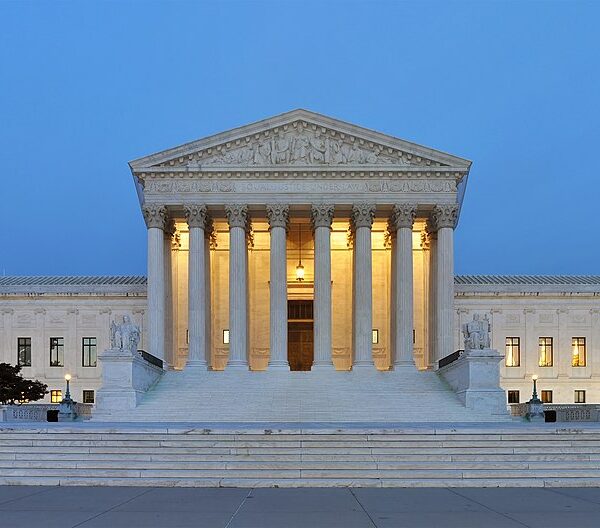

At the time, banking regulators—including the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Federal Reserve—issued guidance emphasizing “reputational risk” considerations for financial institutions.

JPMorgan has stated that it does not close accounts for political reasons, though it has acknowledged that reputational and regulatory factors influenced decisions during a period of heightened scrutiny across the banking sector.

Trump has disputed that explanation, arguing that the decision amounted to unfair financial treatment. JPMorgan has been contacted for comment.

Trump also rejected a report from The Wall Street Journal suggesting he had previously discussed Jamie Dimon as a potential Federal Reserve chair, calling the report inaccurate.

The developing dispute highlights ongoing debates over banking practices, regulatory authority, and whether financial institutions should play a role in limiting access to essential services based on political controversy—issues that continue to resonate with many Americans.