Here are the facts.

Millions of Americans with student debt are about to face a harsh financial reality—and it’s not President Trump’s fault. After five years of government handouts and paused payments, the bill is finally coming due. And now, nearly 2 million student loan borrowers could see their paychecks docked and their tax refunds seized—some even risk losing a portion of their Social Security benefits.

🚨 Student Loan Crisis Hits Hard This Summer

According to a new report from credit agency TransUnion, 6 million Americans are already 90 days or more behind on their federal student loans. That’s not a glitch—it’s a massive financial red flag. And by August, another 1 million borrowers could officially enter loan default, triggering a wave of federal collections.

❗ Default means real consequences: garnished wages, withheld refunds, and slashed Social Security checks.

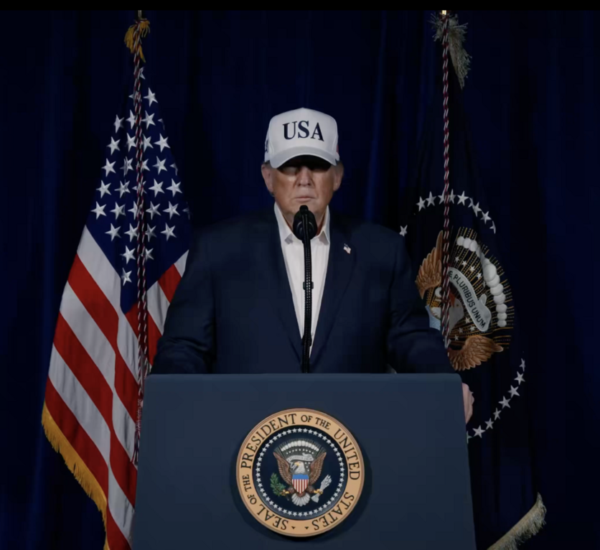

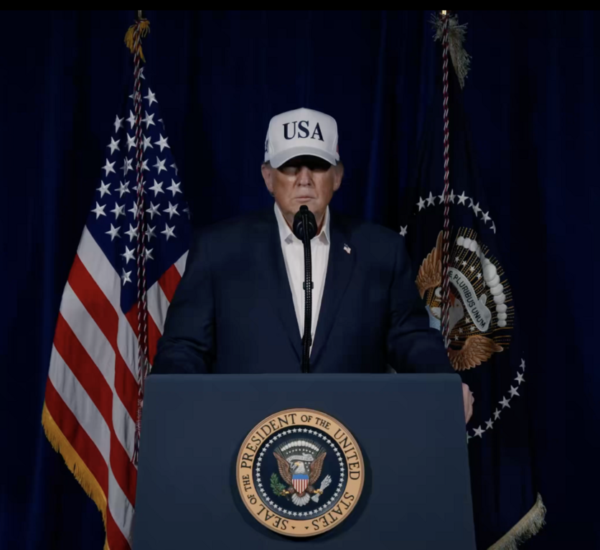

This major shift follows the Trump administration’s decision to end the COVID-era freeze on collections—a policy originally put in place under Democrats that allowed borrowers to skip payments for years without penalty.

💸 Who’s Affected—and What Happens Next

Once a borrower is 270 days past due, they’re officially in default. That opens the door for the federal government to:

- Garnish up to 15% of a borrower’s wages

- Seize tax refunds

- Reduce Social Security payments (though Trump paused this—for now)

A whopping 31% of borrowers are already 90+ days delinquent. That’s the highest percentage ever recorded. For comparison, back in February 2020, before the pandemic giveaways started, only 12% were that far behind.

📉 Credit Scores Plunge—And The Clock Is Ticking

TransUnion reports that newly delinquent borrowers are seeing their credit scores drop by an average of 60 points. That can hurt everything from buying a car to renting a home. And while delinquency doesn’t yet mean default, it’s a slippery slope.

The silver lining? Delinquency rates leveled off between March and April—but millions are still at risk. In fact, the Treasury Department already sent out 195,000 warning letters in May, notifying borrowers that collections—including wage garnishments—could begin as early as this summer.

👴 Retirees Beware: Social Security at Risk

While President Trump has temporarily paused the garnishment of Social Security benefits, the threat remains for hundreds of thousands of older Americans who carry student debt. For many seniors on fixed incomes, even a small reduction could spell trouble.

📊 The Big Picture: $1.6 Trillion in Unpaid Student Loans

As of April, the Education Department reports that 43 million borrowers owe more than $1.6 trillion in federal student debt. After years of delays, the Trump administration is taking action, enforcing repayment while still offering flexibility for those who engage with their loan servicers.

⚠️ If you’re behind on payments, don’t wait—contact your loan provider to explore options like income-driven repayment plans before the penalties hit.

✅ Bottom Line: Personal Responsibility Is Back

This isn’t about punishing Americans—it’s about restoring fiscal sanity. After years of reckless spending and government bailouts, accountability is finally returning under strong leadership.

President Trump isn’t “docking wages”—he’s ending a free ride that’s cost taxpayers billions.