Americans across the nation have been begging for this.

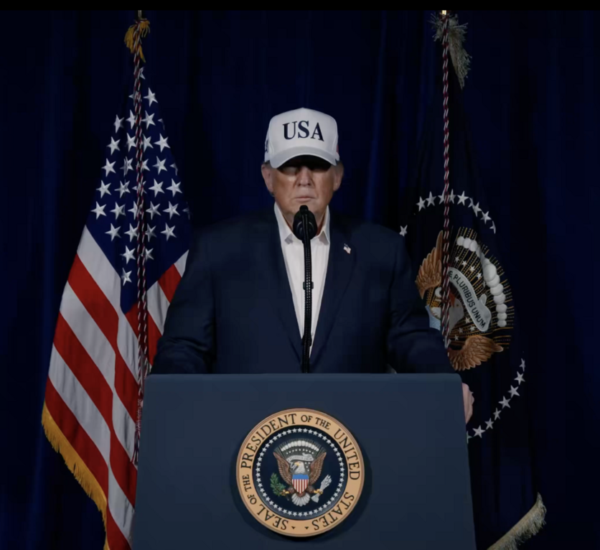

President Donald Trump announced Tuesday that Americans could soon see the complete elimination of federal income taxes, a proposal he says is now realistic due to massive tariff revenue pouring into the U.S. Treasury under his administration.

For millions of seniors, retirees, and working families struggling under inflation, Trump’s proposal would mark one of the most significant tax relief victories in American history.

Trump: “You May Not Even Have Income Tax to Pay”

Speaking after a cabinet meeting, Trump told reporters that America is approaching a moment where citizens keep more of their own money instead of sending it to Washington.

“At some point in the not-too-distant future, you won’t even be paying income tax,” Trump said. “Whether we eliminate it entirely or bring it down to almost nothing, Americans will finally get real tax relief.”

Trump credited record-breaking economic activity and tariff-driven revenue for making the idea achievable.

Tariffs, Not Taxes: Trump’s New Economic Model

Trump has long argued that instead of taxing American workers and retirees, the United States should generate revenue by taxing foreign countries that sell into the U.S. market.

Earlier in his second administration, he proposed eliminating income tax for Americans earning under $150,000 — replacing it with tariff revenue that targets foreign producers, not American families.

In January, Trump made the case plainly:

“Instead of taxing our citizens to enrich foreign nations, we should be tariffing foreign nations to enrich our citizens.”

The message resonates strongly with older Americans, particularly those on fixed incomes who feel squeezed by income taxes, inflation, and global competition.

Trump Reaffirms His Position: “Why Not?”

When asked by Joe Rogan if he was serious about removing personal income taxes, Trump responded:

“Yeah, sure — why not?”

He argued that tariffs can fund the federal government without draining the paychecks of middle-class Americans, retirees, and small business owners.

This marks Trump’s most explicit endorsement of a tariff-funded government.

A Historic Transformation of the American Tax System

Ending the federal income tax would be the largest overhaul of the U.S. tax system in more than a century. What once seemed impossible is now entering the mainstream because of Trump’s leadership and economic strategy.

And for older Americans — especially those living on pensions, Social Security, or investment income — the idea of zero income tax represents a dramatic shift in financial freedom.

How This Impacts Seniors, Retirees, and the Middle Class

Abolishing income tax would provide:

- Major savings for retirees who currently pay taxes on retirement income

- More disposable income for families facing rising costs

- Lower tax burdens on small businesses and self-employed Americans

- Generational economic relief for middle-class households

This is why the proposal is gaining traction among voters age 50+, who overwhelmingly favor reducing Washington’s reach into their wallets.

A Tough Political Fight — But Trump Is Pushing Forward

Implementing this plan would require major tax-code revisions and cooperation from Congress, where Republicans hold a narrow House majority. Even so, Trump remains the only modern president seriously pushing the idea onto the national debate stage.

With tariffs already generating massive revenue, the question is shifting from “Is this possible?” to “How fast can it be done?”

A Fringe Idea No More — Trump Moves It Into the Mainstream

For decades, abolishing the income tax was considered politically impossible. But Trump’s aggressive tariff strategy — combined with voter frustration over inflation and taxes — has transformed the conversation.

Older Americans, in particular, see the proposal as a once-in-a-generation opportunity for real tax relief.

And with President Trump now making his boldest statement yet, the future of the U.S. tax system may be on the verge of a historic reset.