Why would Democrats do this?

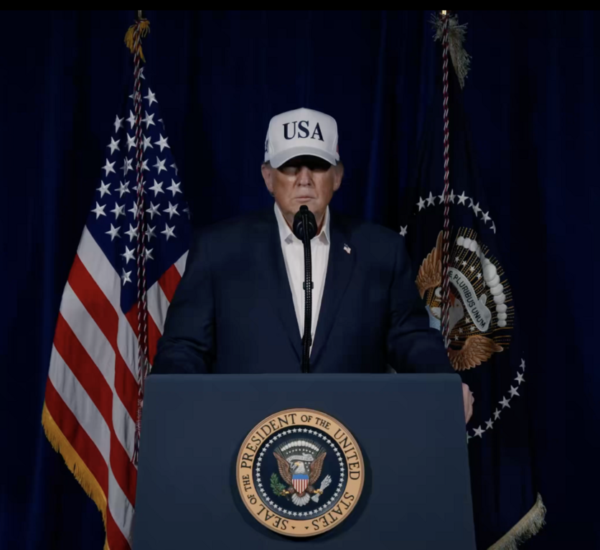

In a stunning development, Treasury Secretary Scott Bessent revealed Wednesday that several Democrat-led states are blocking major tax relief provisions from President Donald Trump’s One Big Beautiful Bill Act (OBBB)—a historic tax reform package signed on July 4.

For millions of Americans expecting long-promised financial relief, Bessent says these states are standing in the way.

Democrat States Accused of Blocking Tax Cuts for Their Own Residents

Bessent directly criticized officials in New York, Colorado, Illinois, and Washington, D.C., accusing them of deliberately denying residents access to Trump’s tax cuts.

He called their actions “a blatant act of political obstructionism” and a “direct assault on the families and workers Democrats claim to champion.”

According to Bessent, the refusal to adopt OBBB provisions means families in these states will continue paying higher taxes, even as the national economy strengthens under Trump’s policies.

“Hardworking Americans Are the Ones Paying the Price”

Bessent emphasized that the holdout states are hurting low- and middle-income Americans the most, especially seniors, service workers, and families struggling with inflation.

“By denying access to these tax cuts, Democrat politicians are robbing their own residents of the relief they deserve,” Bessent said. “They’re increasing the financial pressure on workers who already face higher costs.”

To drive his point home, Bessent posted a meme on X portraying Kathy Hochul, Jared Polis, and JB Pritzker as “the Grinches Who Stole Christmas.” It quickly gained traction among frustrated taxpayers.

Democrat Leaders Push Back—But Offer Few Solutions

A spokesperson for New York Governor Kathy Hochul attempted to deflect blame by attacking Trump’s economic agenda, claiming tariffs have raised consumer prices.

The spokesperson accused Bessent of “wasting taxpayer dollars with Photoshop,” but provided no explanation for why New York refuses to pass along the federal tax relief.

Offices for Illinois Gov. JB Pritzker and Colorado Gov. Jared Polis did not respond to requests for comment.

What the OBBB Act Actually Delivers

Trump’s tax package has been widely praised as the most pro-worker, pro-family reform in a generation, offering immediate benefits, including:

✔ No Tax on Tips

A major win for service-industry employees who depend on tips to survive.

✔ No Tax on Overtime

Rewarding Americans who put in extra hours to provide for their families.

✔ New Senior Deduction

Relief for retirees who rely on Social Security and are feeling the strain of rising costs.

These reforms are designed to put more money back into Americans’ pockets—unless blocked by state leaders.

Bessent: “Americans Voted for Relief, Not Roadblocks”

Bessent said President Trump’s vision is clear: real relief for forgotten American workers, strong families, renewed business confidence, and long-term growth.

He urged Democrat-led states to stop using citizens as political pawns.

“The American people voted for bold change—not bureaucratic obstruction,” he said. “It’s time for these governors to follow the will of the voters.”

He added that the Treasury is ready to help any state implement these reforms, but it will not “stand idly by while obstruction drags down the national recovery.”

Bottom Line: This Is About Putting America First Again

The Biden-era economic strain hit older Americans the hardest. Trump’s updated tax plan aims to reverse that damage, strengthen household budgets, and support workers across every age group—especially seniors.

But as long as Democrat-led states refuse to cooperate, millions of Americans will be blocked from receiving the relief they were promised.

Trump’s message is simple: America First means American families first.