Even Democrats are stunned.

$12 Million in Alleged Public Assistance Fraud Sparks Major Court Battle in Massachusetts

In a stunning political development, a Democratic state official in Massachusetts is taking members of her own party to court after uncovering nearly $12 million in alleged fraud involving taxpayer-funded public assistance programs.

At a time when inflation continues to strain retirees and working families alike, the issue of government accountability is hitting home — especially for Americans over 50 who have watched decades of rising spending and limited oversight.

$12 Million in Alleged Government Fraud Identified

Diana DiZoglio, Massachusetts’ elected state auditor, revealed that her office identified nearly $12 million in suspected fraud in fiscal year 2025 alone across several public assistance programs.

That’s $12 million in potential misuse of taxpayer dollars — in just one year.

For many citizens living on fixed incomes, that number raises serious questions:

Where is the oversight? Who is watching the spending? And why wasn’t this caught sooner?

72% of Voters Demanded Transparency

In 2024, Massachusetts voters overwhelmingly approved a ballot measure granting the state auditor authority to audit the Legislature. The measure passed with a striking 72% support, drawing backing from Democrats, Republicans, and independent voters.

The message from voters was clear: government transparency should apply to everyone — including lawmakers themselves.

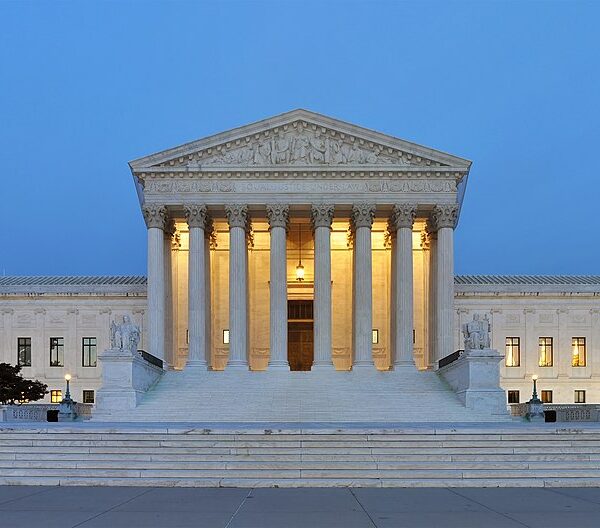

Yet DiZoglio says legislative leaders have refused to provide the documents needed to conduct the audit. As a result, she has filed a complaint with the Massachusetts Supreme Judicial Court to enforce the will of the voters.

Massachusetts’ Unique Public Records Exemption

According to the auditor’s office, Massachusetts is currently the only state where the Legislature, governor’s office, and judiciary exempt themselves from standard public records laws.

That means certain financial documents — including state contracts, receipts, and internal spending records — are shielded from public scrutiny.

For Americans who believe in constitutional accountability and open government, that exemption raises serious concerns.

After all, taxpayers fund these institutions.

Attorney General Pushes Back

The legal dispute escalated after the state’s attorney general questioned whether the auditor has the authority to pursue the lawsuit.

The attorney general’s office argues that constitutional provisions dating back nearly 250 years may limit the auditor’s ability to audit the Legislature.

Now the matter appears headed toward a high-stakes court decision that could determine whether voter-approved oversight laws can override long-standing political protections.

Protecting Programs — Not Attacking Them

Importantly, DiZoglio has emphasized that exposing fraud is not about dismantling public assistance programs. She has shared that she herself grew up in a household that relied on programs like WIC before her family became financially stable.

Her position is straightforward:

Fraud hurts the very people these programs are meant to help.

When funds are diverted through waste, fraud, and abuse, fewer resources are available for seniors, disabled citizens, struggling families, and those genuinely in need.

Why This Matters to Taxpayers

For Americans over 50 — many of whom have paid taxes for decades — government accountability is not a partisan issue. It’s a matter of fairness.

When voters demand audits and transparency, should elected officials comply?

Or should institutional protections shield politicians from oversight?

The Massachusetts case could become a national example of whether government transparency laws have real power — or whether political resistance can override voter intent.

As this legal battle moves forward, many taxpayers across the country will be watching closely.

Because at the end of the day, it’s not just about one state.

It’s about whether government answers to the people — or to itself.