Here’s what America’s seniors need to know.

Millions of American seniors just got a wake-up call — and it’s coming straight from Capitol Hill. Lawmakers are warning that Social Security benefits could face major changes in the coming years, and they’ve introduced new legislation they claim will “protect” retirees from privatization and service cuts.

The Hands Off Our Social Security Act

The bill, called the “Hands Off Our Social Security Act,” would require Congressional approval before the Social Security Administration (SSA) could make big changes to its operations. That includes:

- Blocking any move toward privatizing Social Security.

- Preventing staffing cuts without a full vote in Congress.

- Stopping the closure of local Social Security offices unless an impact report is released.

- Guaranteeing seniors access to in-person and phone service.

- Mandating annual audits to keep the SSA accountable.

The Clock Is Ticking on the Trust Fund

The warning comes as the Social Security Trustees report that the program’s retirement trust fund could run dry by 2033. If that happens, payroll taxes would only cover a portion of benefits — meaning automatic cuts could hit seniors’ checks unless lawmakers take action.

For over 70 million Americans who depend on these payments, that could mean the difference between living comfortably and financial hardship.

Political Battle Over the Future of Social Security

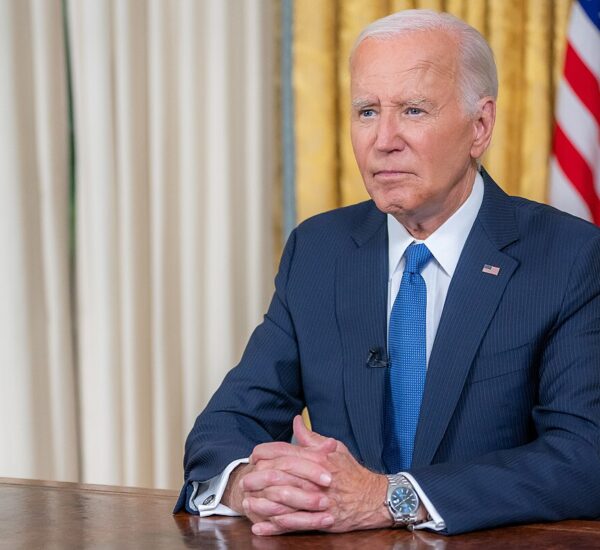

Democrats pushing the bill — led by Rep. Melanie Stansbury of New Mexico — accuse President Trump’s administration of trying to “gut” the system by streamlining staff, closing offices, and modernizing services.

Republicans, however, say Democrats are playing politics with fear, pointing out that no benefits have been cut. They argue that modernization is essential to make Social Security sustainable for the long haul.

“Without reforms, Social Security’s biggest threat isn’t privatization — it’s going broke,” conservative analysts warn.

Experts: Real Danger Is Insolvency, Not Privatization

Financial specialists agree that the greatest risk is insolvency. Without adjustments to the benefit formula, retirement age, or payroll tax system, the trust fund could collapse. Conservatives insist that growing the economy, cutting waste, and promoting work are the best ways to protect seniors’ benefits — not adding more bureaucratic red tape.

What It Means for Seniors

While the bill is unlikely to pass in a Republican-controlled Congress, the debate is a stark reminder: the future of Social Security is not guaranteed. Seniors who worked and paid into the system for decades are now facing political battles that could determine the size of their retirement checks in just a few short years.