Americans have been issued a strange warning.

Concerns are growing that rushed changes to federal mortgage rules could put American taxpayers back on the hook for another housing meltdown—something many voters over 50 still remember all too well.

A coalition of housing and consumer advocacy groups is urging the Trump administration’s housing regulator to slow down proposed changes to how mortgage credit scores are used, warning that poorly executed reforms could raise the risk of widespread defaults and future taxpayer bailouts.

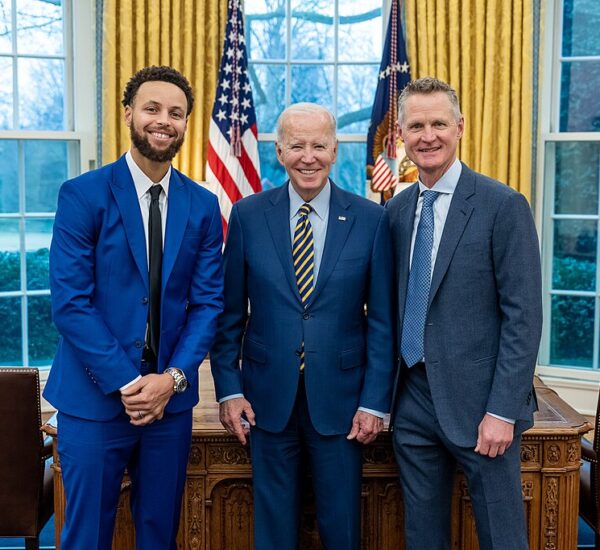

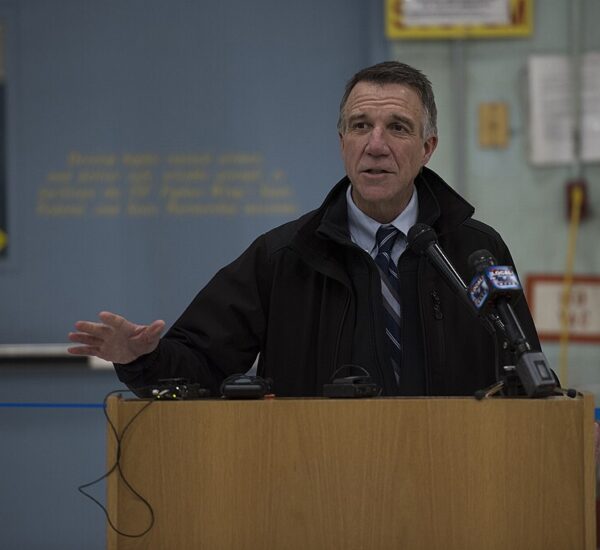

In a detailed letter to Bill Pulte, the director of the Federal Housing Finance Agency, the 35 organizations laid out what they say are critical safeguards needed as the administration works to improve housing affordability nationwide.

While the groups acknowledged the goal of expanding access to homeownership, they stressed that history shows what happens when Washington moves too fast and ignores financial reality.

Concerns Over New Mortgage Credit Score Rules

At the center of the warning is the administration’s plan to allow mortgage lenders to choose between the long-standing credit score system and newer, alternative models.

The coalition cautioned that if these changes are not carefully structured, they could:

- Complicate mortgage lending

- Distort loan pricing

- Increase financial risk inside the housing market

- Weaken the stability of Fannie Mae and Freddie Mac

For many Americans, those risks sound uncomfortably familiar.

Why Timing Matters

The groups also raised alarms about how the new credit score models might be introduced.

They argued that rolling out the models in stages—rather than all at once—could:

- Increase costs for lenders and borrowers

- Make mortgage risk harder to measure

- Expand taxpayer exposure if loans begin to fail

A simultaneous rollout, they said, would reduce confusion and help maintain market stability.

Calls for Transparency

Another major concern involved transparency.

The coalition urged regulators to publicly release the data used to validate and approve new credit score models, arguing that lenders, investors, and consumers deserve to understand how these systems are being evaluated.

Without that transparency, critics warn, risky loans could quietly spread through the system before problems become obvious.

A Warning From the 2008 Financial Crisis

The letter pointed directly to past government housing policies that encouraged homeownership among borrowers who were not financially prepared.

“Too often in the past, families not ready for homeownership were pushed into it by government policies,” the group warned, noting that the result was the 2008 financial crisis—when large numbers of bad mortgages collapsed at the same time.

Those failures, they wrote, set off a chain reaction that ultimately forced taxpayers to fund massive bailouts of the financial system.

Why This Matters Now

The coalition concluded by warning that the risk is especially serious today, as recent data shows mortgage delinquencies beginning to rise again.

For many conservative voters, the message is straightforward: expanding access to homeownership should never come at the expense of financial discipline, market stability, or taxpayer protection.

With memories of 2008 still fresh, critics argue that the country cannot afford another experiment that ends with Americans paying the bill.