Get ready.

Millions of Americans could be heading into the next tax season with a welcome financial surprise — and it’s coming directly from President Donald Trump’s latest tax reforms.

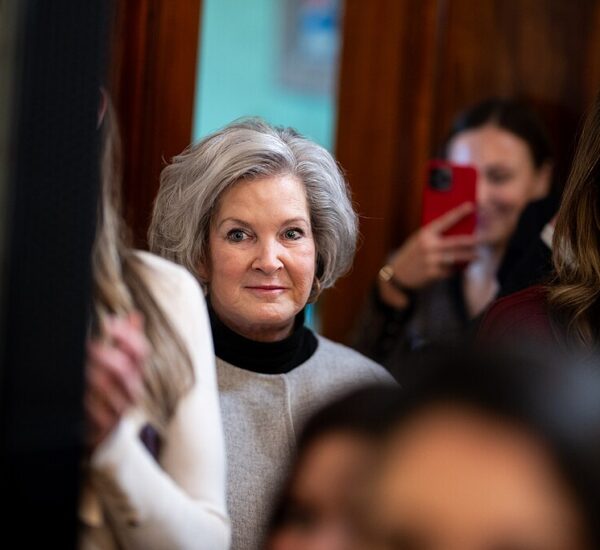

Treasury Secretary Scott Bessent says the tax cuts included in President Trump’s One Big Beautiful Bill Act may result in unusually large refund checks for working Americans, retirees, and seniors when returns are filed next spring.

Speaking on the All-In Podcast, Bessent explained that many households are likely to see significantly higher refunds because the tax cuts apply retroactively — while paycheck withholdings stayed the same.

That combination, he said, sets the stage for what could be one of the largest refund seasons in years.

Bigger Refunds Because Withholdings Never Changed

Bessent, who is also serving as acting commissioner of the Internal Revenue Service, said most Americans continued paying higher withholding amounts throughout the year because payroll tables were never updated after the law passed.

“As a result,” Bessent explained, “working Americans could see sizable refunds instead of small increases spread across each paycheck.”

According to Bessent, many households may receive refunds ranging from $1,000 to $2,000, depending on income level and the number of wage earners in the home.

For seniors, retirees, and families already squeezed by inflation, rising grocery costs, and higher utility bills, that kind of refund could make a meaningful difference.

Independent Analysts Back Up the Prediction

Nonpartisan analysts at the Tax Foundation agree that the new law is likely to boost refunds well above normal levels.

In a recent report, the foundation estimated that Trump’s legislation reduces individual tax burdens by approximately $144 billion for the upcoming tax year. Outside estimates suggest that as much as $100 billion of those savings could be returned directly to taxpayers through larger refund checks.

Because withholding rates were never adjusted, taxpayers effectively overpaid throughout the year — and will now receive that money back all at once when filing.

Why Many Americans Will See the Money All at Once

Normally, tax cuts show up gradually through higher take-home pay. But in this case, the IRS did not implement updated withholding tables after the law went into effect.

That means:

- Workers continued having too much tax withheld

- Retirees with part-time income may have overpaid

- Families did not see relief during the year — but will now receive it in lump-sum refunds

For many Americans, especially those on fixed incomes, a large refund check can help offset rising living costs or replenish savings.

Key Tax Cuts Driving Higher Refunds

The Tax Foundation identified several major provisions in Trump’s bill that could push refunds higher, including:

- A larger standard deduction

- An expanded child tax credit

- A higher SALT deduction cap

- New or expanded senior tax deductions

- Deductions for auto loan interest

- Relief for tip income

- Expanded deductions for overtime pay

Together, these provisions represent one of the most taxpayer-friendly reforms in recent years — particularly for middle-class families and older Americans.

Bottom Line

While not every filer will receive a dramatic increase, analysts say average refunds could rise by up to $1,000 for many Americans — with some households seeing even more.

If projections hold, President Trump’s tax plan may turn the upcoming filing season into a welcome financial reset for millions of Americans — especially seniors and working families feeling the effects of inflation.